Gold and silver have long been considered reliable investment options. But which one is better for long-term gains? The gold-silver ratio can help investors decide when to put more money into gold or silver based on price trends.

Let’s explore the recent performance of both metals, the reasons behind their rising prices, and what the future might hold. 📈

Gold and Silver Performance in 2025 🚀

While stock markets have struggled, gold and silver have delivered impressive returns this year. Gold prices have surged by over 40% in the past year, while silver has gained nearly 34%.

Current Prices:

- Gold Price: $3,030 per ounce (₹88,500 per 10 grams in India)

- Silver Price: $33 per ounce (₹1,00,000 per kg in India)

These significant returns have sparked investor interest. But will this trend continue in the coming years? Let’s break it down. 🔍

Why Are Gold and Silver Prices Rising? 📊

Silver: A Rising Star 🌟

For the past five years, global silver demand has exceeded supply. In 2025, demand is expected to stay strong at 1.20 billion ounces, while supply is projected to increase slightly to 1.05 billion ounces, still leaving a gap.

Factors Driving Silver Prices:

- Growing Industrial Demand 🔧 – Silver is widely used in green technologies, including solar panels and electric vehicles, increasing its demand.

- Investment Demand 📈 – More investors are looking at silver as a safe-haven asset, further boosting prices.

Since the silver market is much smaller than gold (with an annual turnover of around $30 billion), even small shifts in supply or demand can cause significant price fluctuations.

Gold: The Ultimate Safe-Haven Asset 🏆

Gold is widely recognized as a hedge against inflation and economic instability. Several factors have contributed to its strong price movement:

- Central Bank Buying 🏦 – Global central banks are buying over 1,000 tonnes of gold annually, supporting prices.

- Economic Uncertainty 🌍 – The possibility of a U.S. recession and global trade tensions (like Trump’s tariff policies) create a favorable environment for gold.

- Federal Reserve Interest Rate Policy 📉 – If the U.S. Federal Reserve cuts interest rates, the U.S. dollar could weaken, further driving gold prices higher.

Understanding the Gold-Silver Ratio 📏

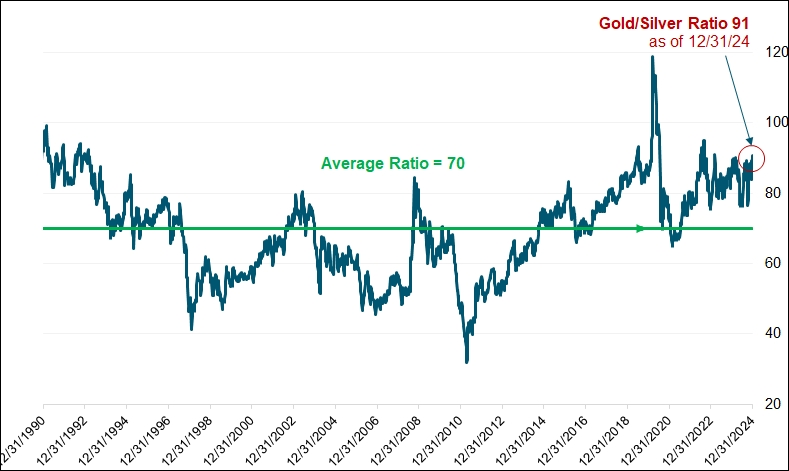

The gold-silver ratio measures how many ounces of silver are needed to buy one ounce of gold. Historically, this ratio has averaged 70:1 but has risen significantly in recent years.

- Current Ratio: 91:1 📊

- Implication: Silver is still undervalued compared to gold. If the ratio returns to its long-term average, either silver prices will rise, or gold prices will stagnate or fall.

How to Use the Gold-Silver Ratio in Investing 🤔

- When the ratio is high (like now), silver might be the better investment as it has room to catch up.

- When the ratio is low, gold might offer a safer long-term return.

Gold vs Silver: Which is Better for the Long Term? ⏳

5-Year Outlook 🔮

- Gold: Likely to remain strong if economic uncertainties persist.

- Silver: Industrial demand and limited supply could push prices higher.

10-Year Outlook 🔮🔮

- Gold: If central banks continue accumulating gold, its price could remain stable or grow steadily.

- Silver: More upside potential due to green energy demand.

15-Year Outlook 🔮🔮🔮

- Gold: Will likely retain its value and remain a safe-haven investment.

- Silver: May outperform gold if industrial applications expand further.

Key Takeaways ✅

- Both gold and silver are solid long-term investments and can balance a portfolio.

- The gold-silver ratio helps determine which metal is undervalued at a given time.

- Gold is a traditional hedge against inflation and economic instability.

- Silver has higher growth potential due to increasing industrial use.

Investing in both gold and silver can provide stability and potential for higher returns. Keeping an eye on the gold-silver ratio will help investors make informed decisions. 📊💰

“Want to know expert insights by Arun Kejriwal? Check out his analysis on Indian market trends!”

Disclaimer: This article is for informational purposes only and not financial advice. Always do your research before investing.

source : financialexpress , Google Finance , bankrate