SEBI has introduced a major regulatory framework to streamline algo trading in India—impacting brokers, algo vendors, and retail investors. These changes, effective from October 1, 2025, aim to make algo trading safer, more transparent, and regulated for everyone involved.

What Is SEBI’s New Circular About?

SEBI aims to bring accountability and regulation to algo trading, especially API-based systems used by brokers and individual traders. The key focus areas of the circular are:

- Mandatory registration of algos

- Static IP-based order flow

- Vendor empanelment

- Monitoring and compliance protocols

This is a significant move to curb unregulated account management and protect retail investors.

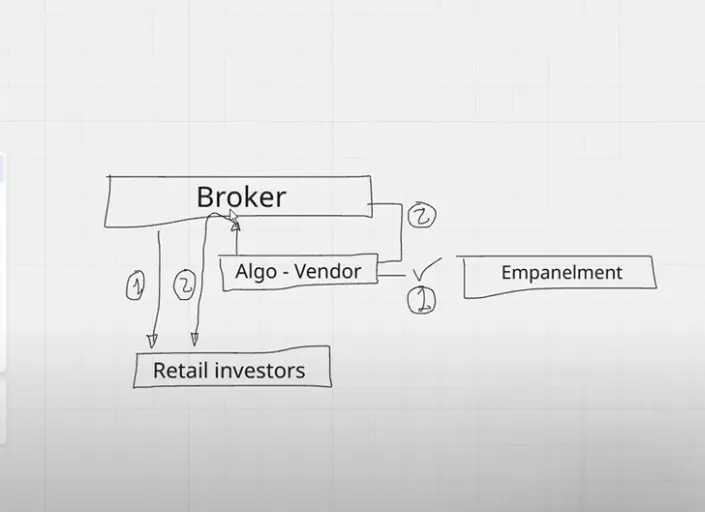

3 Stakeholders Identified by SEBI

Brokers will play a central role in implementing SEBI’s guidelines. They must:

1. Brokers

- SEBI has placed the responsibility on brokers to verify algos, register strategies, and approve vendor registrations.

- Monitor all algo activities

- They also have to implement a static IP system.

- Brokers verify and register algos from vendors, and pay them as per the collaboration terms.

💡 Algo will run on broker servers. Orders are routed through registered IP and Algo ID.

While Generating an API with the Broker, You Must Now Add a Static IP

Good News: Brokers Can Now Offer Their Own Algo Trading Strategies Under SEBI’s New Rules

Reading not your thing? Here’s a simple video on SEBI’s Static IP, Algo Trading & Registration rules:

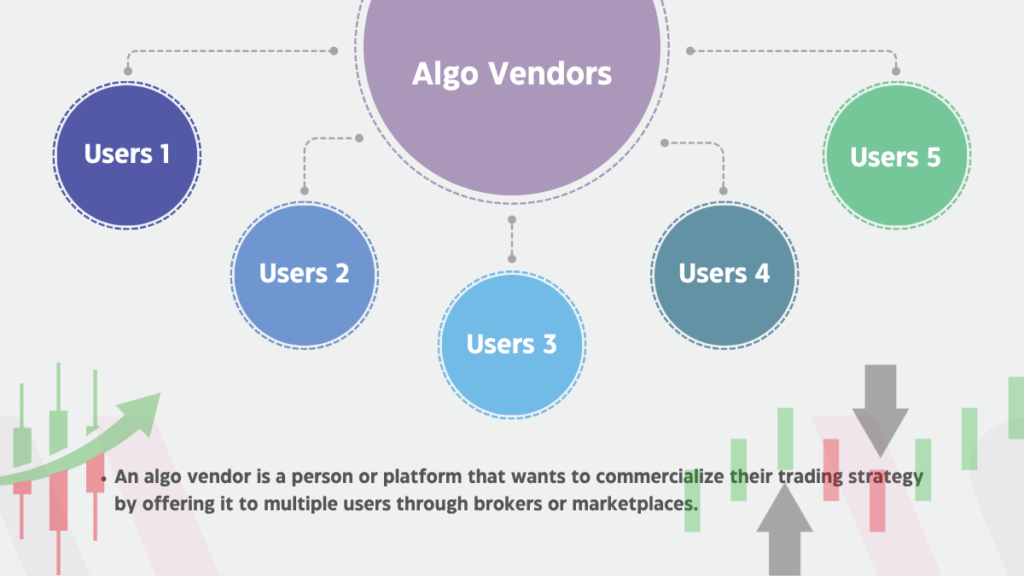

2. Algo Vendors

An algo vendor is a person or platform that wants to commercialize their trading strategy by offering it to multiple users through brokers or marketplaces. They must:

- Needs to be implemented by brokers.

- Submit strategies for verification and approval

- Place orders via broker APIs under the registered algo ID

- Algo vendors register their algos with brokers and get paid as per collaboration terms.

The Algo Registration Process Is Done Through a Ticket.

Algo Registration Timeline & Process

The algo registration process is expected to take around 1 week to 1 month, depending on internal workflows.

Currently, SEBI has not released exact formats or technical implementation details.

If you’re an algo developer or vendor:

- Submit your strategy to your broker.

- Broker reviews and forwards it to the exchange.

- You receive an Algo ID once approved.

- All orders must use the registered static IP and Algo ID.

Algo Vendors Must First Be Empanelled, Then Register Their Algos, and Only After That Can They Act as Agents for Brokers

Once registered, the strategy will run on the broker’s server and vendors can act as agents for brokers.

3. Retail Investors/Traders

1️⃣ Users Who Subscribe to Algos Provided by Vendors

These are retail investors who don’t create their own strategies but want to use ready-made algos.

They can directly subscribe to approved algorithms via brokers.

The algos they access are developed by SEBI-approved vendors and empanelled through the broker.

2️⃣ Traders Who Develop Their Own Strategies or Tools

These are active traders or developers who build custom trading strategies.

The majority of SEBI’s new rules and circulars are designed to guide and regulate this group.

They must register their own algos with the broker.

Both must register a static IP to use APIs.

Two Types of Retail Investors/Traders

🟢 1. Low-Frequency Traders (OPS < 10)

- No need to register the algo strategy — just use SEBI-compliant brokers and empanelled vendors.

- These are traders placing less than 10 orders per second (OPS).

- 99% of retail clients fall under this category.

- Static IP is mandatory to use APIs for algo trading.

🔴 2. High-Frequency Traders (OPS > 10)

- Traders placing more than 10 orders per second.

- Must register their algo strategy with SEBI through a broker or registered algo vendor.

- Orders must be placed using the approved Algo ID.

- Static IP is still mandatory for API access.

💡 What Is a Static IP in Algo Trading?

A Static IP is a fixed internet address used to securely connect your trading platform to the broker’s API. Under SEBI rules, all trades using APIs must go through a registered static IP to ensure safety and accountability.

📌 SEBI allows you to register two IPs:

Secondary IP – Backup in case of failure

Primary IP – Main trading connection

All Orders Must Come Through the Registered Static IP

The New SEBI Algo Trading Rules Will Be Implemented From October 1, 2025

Will Market Orders Be Banned?

Many users are asking: “Will SEBI ban market orders ?”

🟠 Clarification:

As per current understanding, market orders via API may be restricted only in the commodity segment,

Can One Static IP Be Shared With Another Person?🔄

Many users are asking if they can share their static IP with others for algo trading.

🟥 Answer (According to Zerodha):

No — you cannot share your static IP with another user. Each trader must have their own unique static IP.

🟡 However, as per NSE Circular:

Sharing may be allowed among direct blood relations (like mother, father, spouse, or children), using the same algo and same static IP.

⚠️ There’s a contradiction. Final call depends on the broker’s implementation.

What If My Static IP or Server Fails During Live Algo Trading?

A common concern: “What happens if my static IP or server goes down — how do I exit trades?”

✅ SEBI has addressed this by allowing two IPs:

- Primary IP – your main connection for executing orders

- Secondary IP – a backup IP in case the primary fails

This dual-IP provision ensures you can still monitor or exit trades safely if your primary system crashes.

📝 Zerodha has also confirmed this setup in their documentation for API-based algo trading.

I Have an Algo and I’m Managing Multiple Users — How Do I Comply With SEBI’s New Rules?🤖

If you’re managing multiple users with your algo, here’s what you need to do under SEBI’s new framework:

✅ 1. Use a Static IP Address

- You must route all orders through a registered static IP.

- This IP will be linked with your algo and all client accounts.

- You can set a primary and secondary IP for backup purposes (as per SEBI and Zerodha guidelines).

✅ 2. Register Your Algo as an Algo Vendor

- You need to register your strategy with a SEBI-registered broker as an Algo Vendor.

- This includes:

- Submitting your strategy details for verification

- Getting an Algo ID after approval

- Using this Algo ID to execute client trades via the broker API

💡 Once registered, clients can subscribe to your algo via the broker, and you can manage them in compliance with SEBI’s framework.

📜 Why Did SEBI Introduce These New Algo Trading Rules?

SEBI has released new algo trading guidelines to bring transparency, safety, and regulation to the growing world of retail algo trading.

1️⃣ To Control Unregulated Account Management

- Many individuals were offering unofficial algo services, charging fees and promising profits — all without any regulation.

- SEBI aims to stop unauthorized profit-sharing and unverified account handling.

2️⃣ To Empower Retail Investors

- Under the new rules, retail investors can now safely access algo trading, even without developing strategies themselves.

- Brokers can now offer pre-approved algos, allowing more people to automate trading in a secure, regulated environment.

3️⃣ To Ensure Algos Are Verified and Run on Broker Servers

- When an algo is registered via an approved Algo Vendor, it runs on the broker’s secure server.

- Orders are placed directly through the broker’s system, reducing the risk of manipulation or misuse.

📌 This move brings SEBI-level transparency while still giving algo vendors the ability to scale and offer commercial services.

Feel free to contact us if you have any questions or doubts regarding the new SEBI rules. Call or WhatsApp us at +91 9537674727.