Algorithmic trading (algo trading) is becoming increasingly popular among retail investors. To ensure safer participation, the Securities and Exchange Board of India (SEBI) has introduced a new regulatory framework. This framework aims to establish clear rules and responsibilities for brokers, algo providers, and stock exchanges. Let’s dive into the details!

📜 Background of Algo Trading Regulation

SEBI first issued guidelines on algo trading in March 30, 2012, outlining basic rules for automated trade execution. Over the years, additional measures were introduced to strengthen control over algo trading. While institutional investors have been using Direct Market Access (DMA) for algorithmic trading, retail traders are now showing increased interest in using these automated strategies.

With this growing demand, SEBI has decided to refine its regulatory framework to ensure market integrity and investor protection. The new guidelines focus on defining roles, responsibilities, and safeguards for all key stakeholders involved in the trading ecosystem.

🔑 Key Highlights of the New Regulatory Framework

1️⃣ Use of APIs for Algo Trading

- Brokers will be the principal players, while algo providers (fintech firms or vendors) will act as their agents, using APIs provided by brokers.

- Every algo order flowing through a broker’s API must have a unique identifier assigned by the stock exchange.

- Retail investors developing their own algos must register them with the exchange through their broker if they exceed a specific order-per-second threshold.

- Such self-developed algos can only be used for personal or family trading (self, spouse, dependent children, and parents).

- Brokers’ responsibilities include:

- Identifying and categorizing algo orders.

- Restricting open API access and allowing only vendor-specific API keys with static IP whitelisting.

- Using OAuth(Open Authentication) based authentication and enforcing two-factor authentication (2FA) for secure access.

- Dealing only with empaneled algo providers and addressing related complaints.

2️⃣ Stock Brokers’ Responsibilities

Brokers facilitating algo trading must:

- Obtain stock exchange approval for each algo before offering it to clients.

- Tag all algo orders with unique exchange-assigned identifiers for audit trails.

- Seek exchange approval for any modifications to an approved algo.

- Handle investor complaints and ensure API monitoring to prevent misuse.

3️⃣ Approval & Registration of Algo Providers

- Algo providers do not fall under SEBI’s direct regulation but must be empaneled with stock exchanges for better oversight.

- Stock exchanges will set specific empanelment criteria for algo providers.

- Brokers must conduct due diligence before onboarding an algo provider.

- Brokers and algo providers may share revenue from client subscriptions and brokerage fees, but full disclosure of charges must be provided to investors.

4️⃣ Stock Exchanges’ Responsibilities

Stock exchanges will oversee algo trading by:

- Establishing a Standard Operating Procedure (SOP) for algo testing.

- Conducting continuous surveillance of algo orders and their behavior.

- Implementing a ‘kill switch’ to halt trading if an algo malfunctions.

- Setting roles, criteria, and processes for empaneling algo providers.

- Ensuring brokers can differentiate between algo and non-algo orders.

- Releasing FAQs and operational guidelines covering:

- Brokers’ risk management systems for API-based orders.

- Registration process for algos and re-approval requirements.

- Data flow rules between algo providers, brokers, and exchanges.

- Protection of retail investors’ algo strategies through confidentiality agreements.

- Fast-track registration timelines for execution algos.

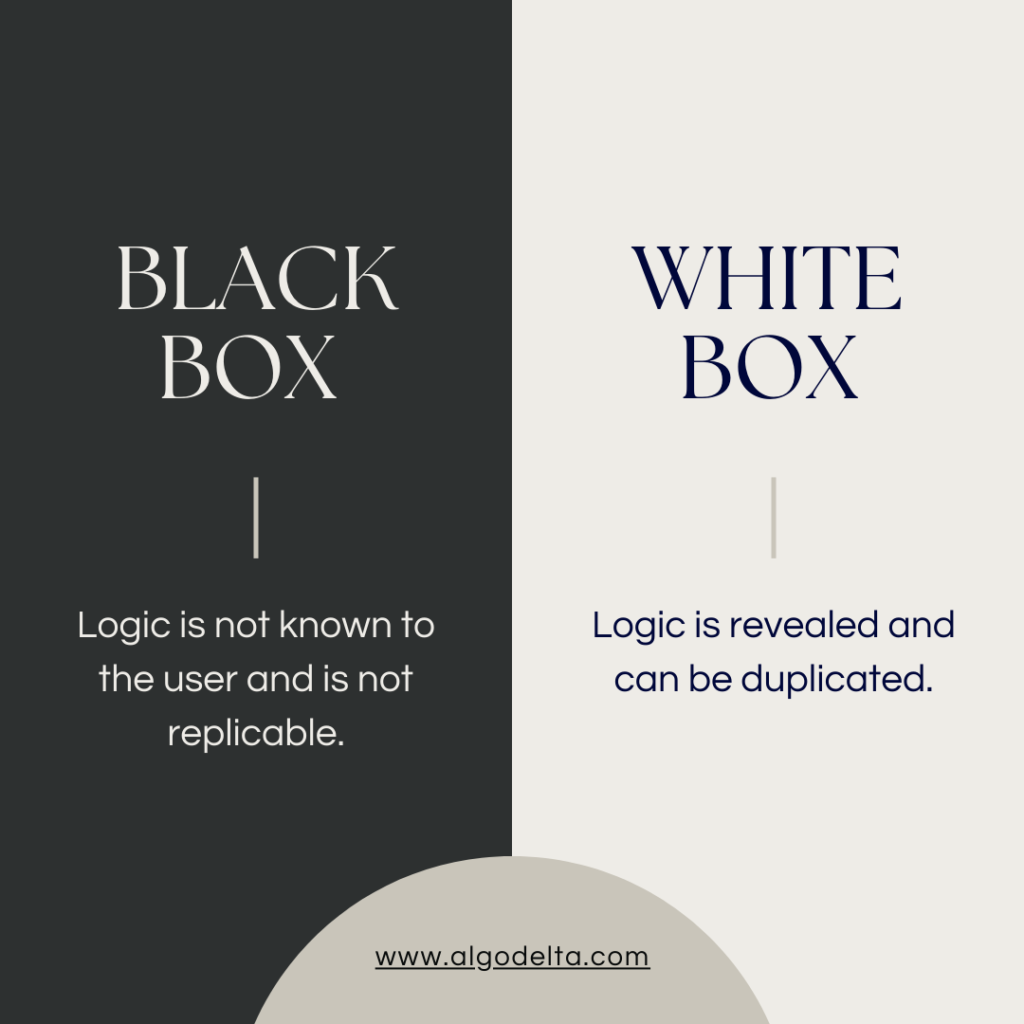

5️⃣ Categorization of Algos

Algos will be categorized into two types:

⬛ Black Box (Proprietary Algos)

- The logic behind these algos is hidden and cannot be replicated.

⬜ White Box (Execution Algos)

- These have fully transparent logic that users can see and understand.

- Black Box Algo providers must 👈🏼

- Register as a Research Analyst and maintain detailed research reports for each algo.

- If the logic changes, the algo must be registered as a new algo with updated research reports.

🗓️ Implementation Timeline

- April 1, 2025 – The Broker’s Industry Standards Forum (BISF) will formulate implementation guidelines under the supervision of stock exchanges and SEBI.

- August 1, 2025 – The new provisions will officially take effect.

📌 What Brokers & Exchanges Need to Do

- Stock exchanges must update their rules and by-laws to implement these changes.

- Brokers must set up systems and procedures to comply with the new regulations.

- All stakeholders (brokers, exchanges, and algo providers) must educate investors about these new safeguards.

🔎 Why This Matters for Retail Traders

These new SEBI guidelines will make algo trading safer and more transparent for retail investors. They ensure:

✅ Better oversight of algo providers

✅ Secure API access & authentication

✅ Clear categorization of algos

✅ More control for brokers & exchanges

✅ Greater protection against algo malfunctions

Retail traders can confidently explore algo trading, knowing that robust checks and balances are in place.

🔗 Final Thoughts

SEBI’s move to refine algo trading regulations is a step toward balancing innovation with investor safety. By clearly defining roles for brokers, algo providers, and stock exchanges, SEBI is fostering a secure environment for retail traders to leverage algorithmic trading.

🚀 Looking to automate your trading? At AlgoDelta, we provide powerful solutions for copy trading, white labeling, strategy development, and consultancy—helping traders and businesses optimize their algo trading experience.

🔔 Stay tuned for updates on trading automation and market insights with AlgoDelta! 🚀

source : sebi , stocksaim

Pingback: NTPC Green Energy: India’s Renewable Shift - Algodelta Blogs