For Placing orders using TradingView indicators to Alice blue follow given steps :

- Connect the Alice blue broker to Algodelta.

- Copy the webhook from AlgoDelta Bridge and paste it into TradingView.

Connect the Alice blue broker to Algodelta.

Step-by-step guide to connecting Alice blue with AlgoDelta – Follow this blog.

Copy Trading With Aliceblue(ANT)

Create Bridge in Algodelta

What is Bridge ?

A bridge acts as a mediator. Using this, you can receive trade signals from third-party platforms like TradingView, MT4/MT5, and AmiBroker with the help of webhooks. You can also place orders in multiple Demat accounts using the AlgoDelta Group Facility.

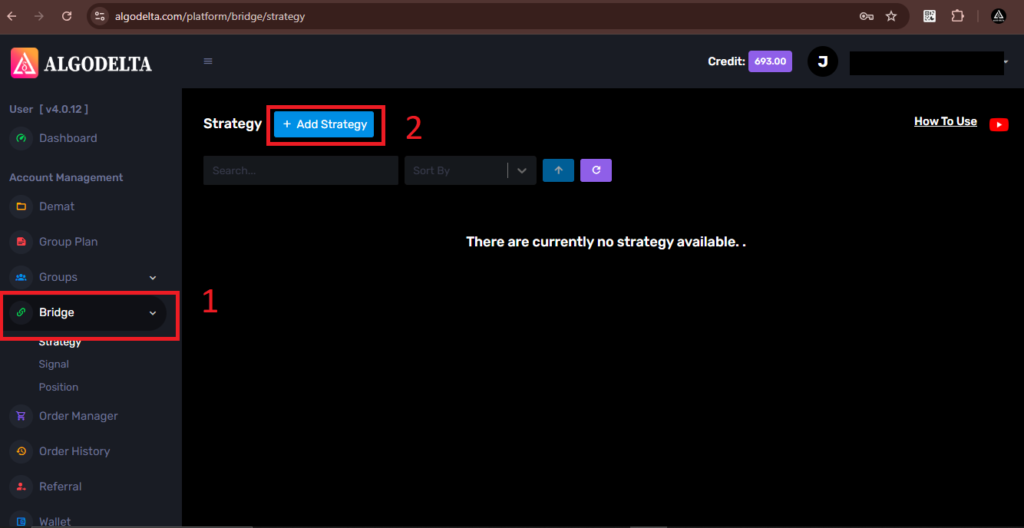

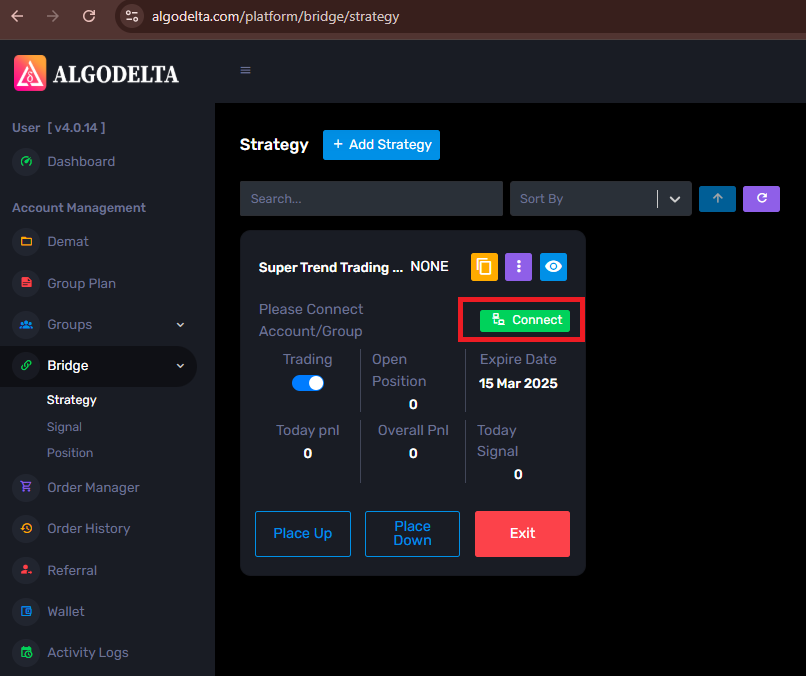

- Click on “Bridge” for trading view signals.

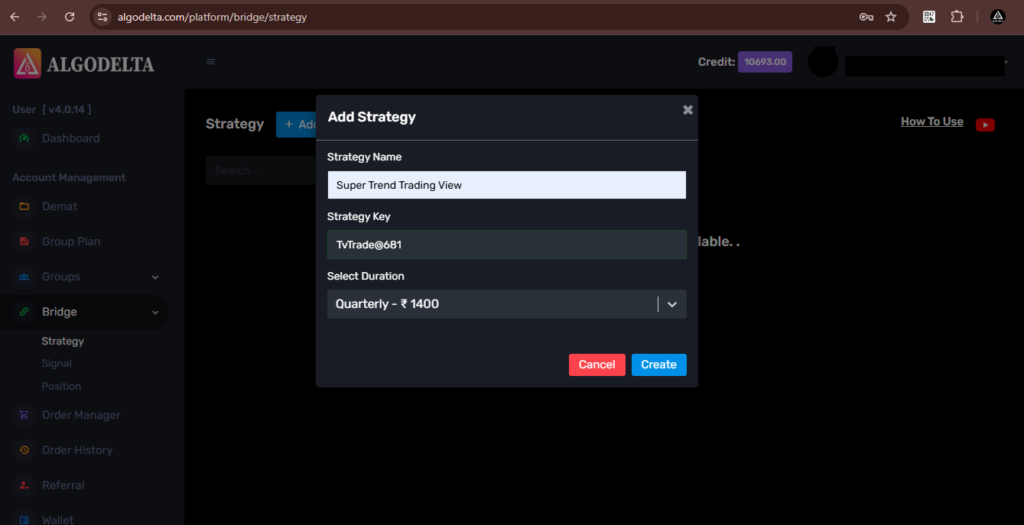

- Then click on “Add strategy” and enter the ‘Strategy Name’ , ‘Strategy Key’ (Strategy Key should be 8 characters long use a mix of uppercase and lowercase letters, numbers, and symbols) , ‘Select Duration’

- And click on create your Bridge is ready.

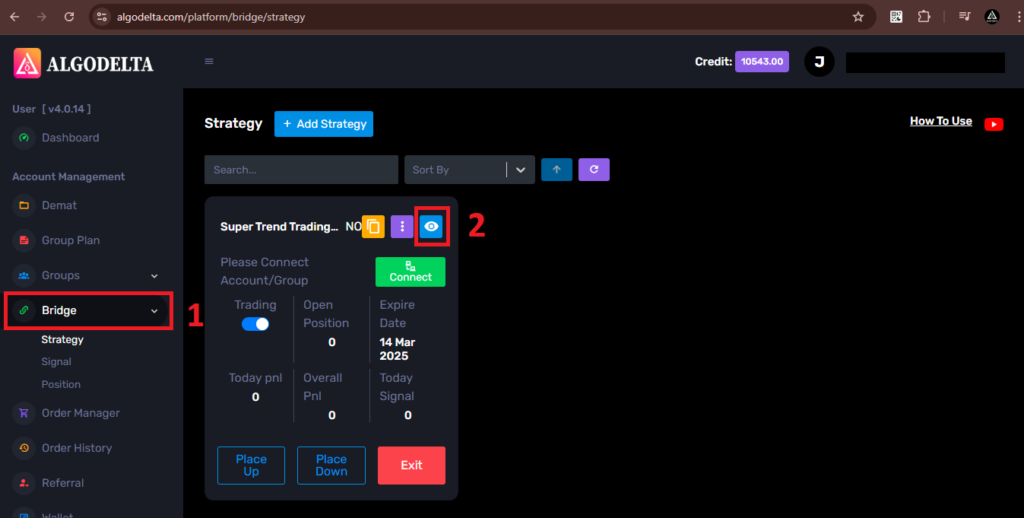

After creating the Bridge, click on the eye button to generate up and down signals.

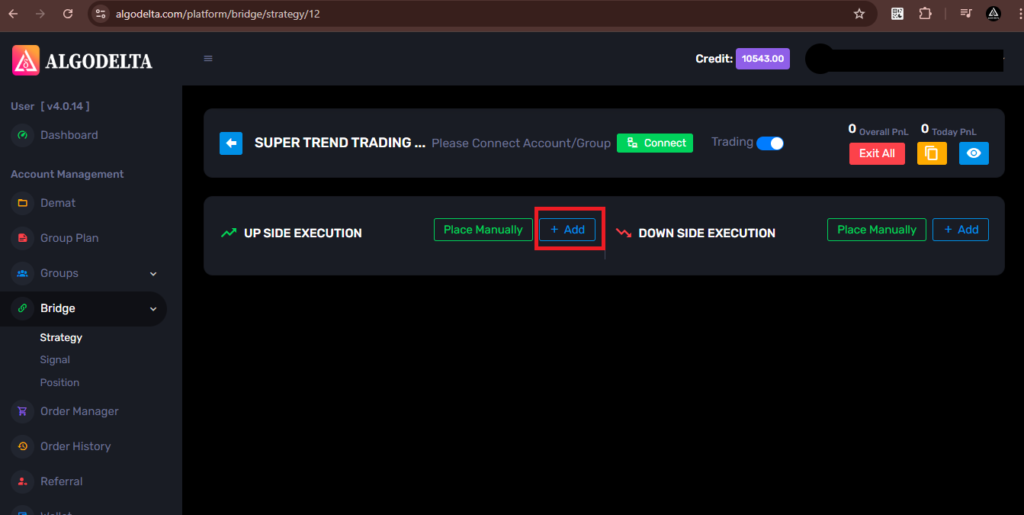

What are UP and DOWN signals?

An UP signal is used when a buy trend occurs, while a DOWN signal is used when a sell trend occurs.

Now, click on the ‘Add’ button to create UP and DOWN signals.

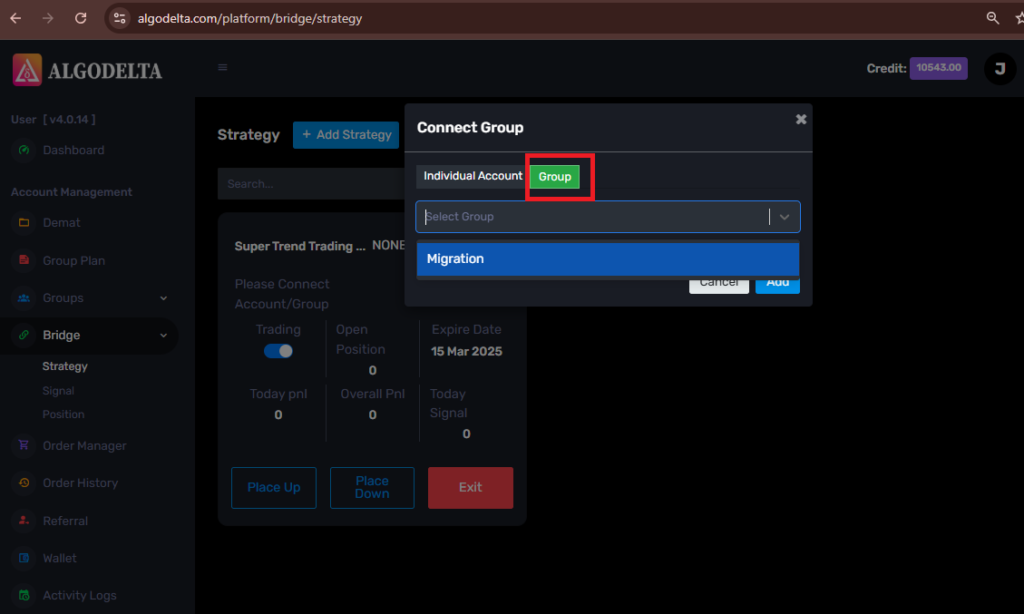

Then, you will see a pop-up menu.

If you want to exit on a Sell signal, enable the ‘Exit on Opposite Signal’ button.

Copy the webhook from AlgoDelta Bridge

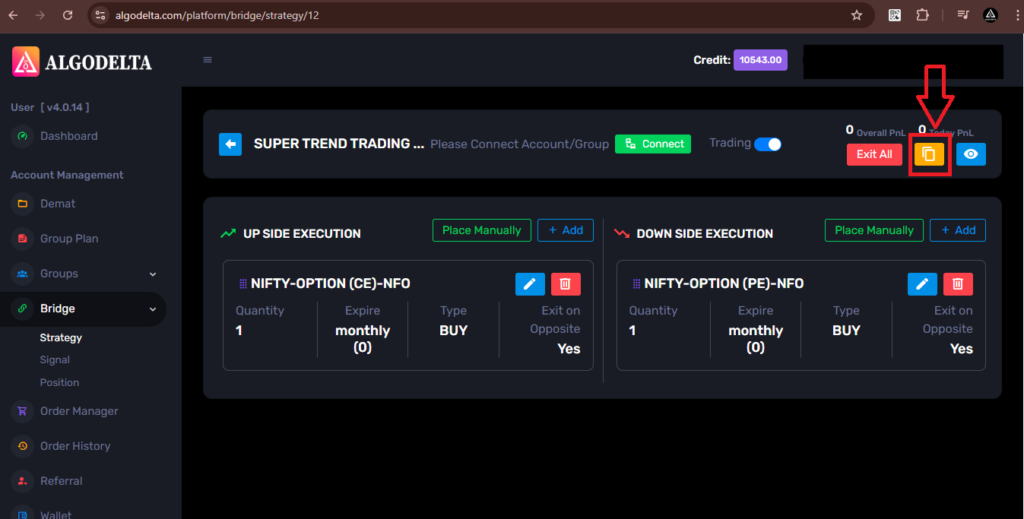

Click on the yellow button to copy the webhook.

Now, open TradingView at https://www.tradingview.com/.

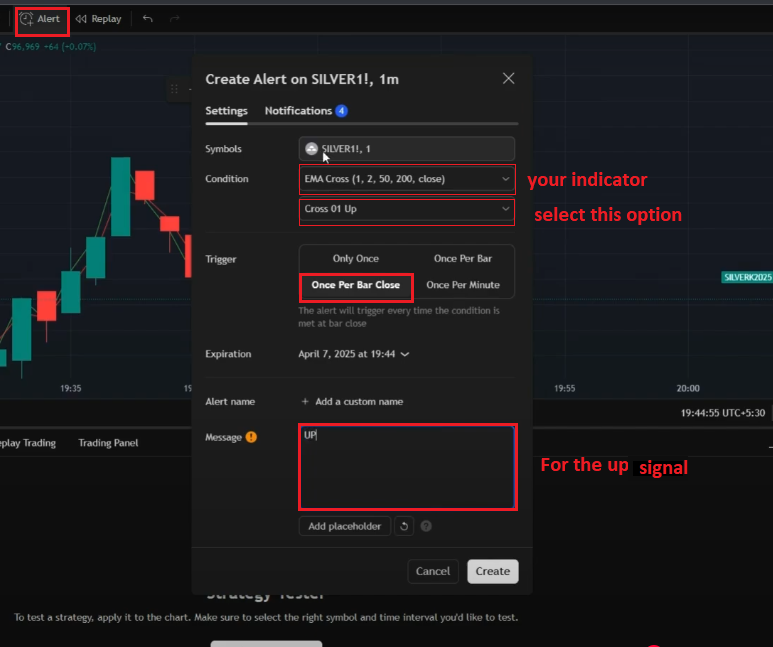

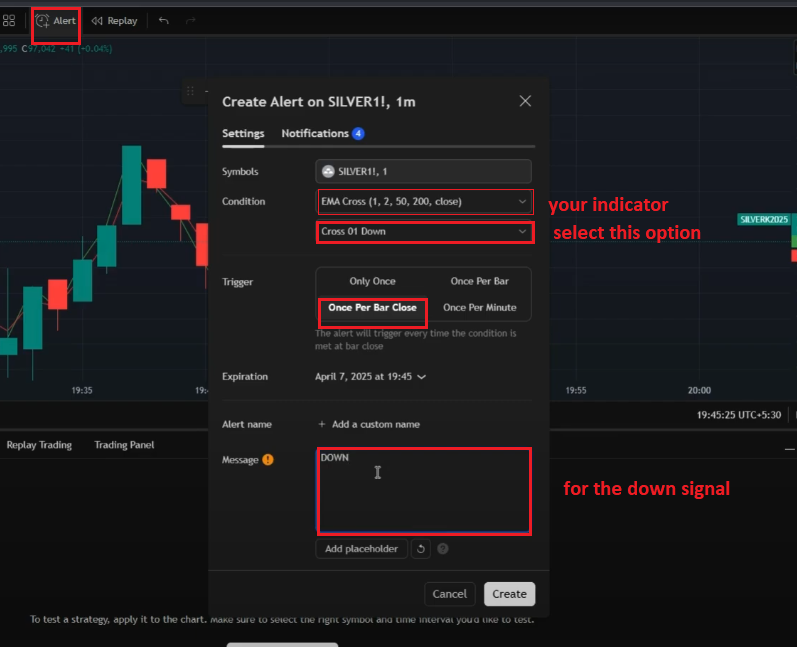

For placing orders using the TradingView indicator:

Watch the video here to learn how to place orders using a TradingView indicator.

For the up signal

For the Down signal

For placing orders in multiple demat accounts:

Follow these screenshots to place orders in multiple demat accounts using TradingView.

Wathch the video on “Place Order from TradingView strategy and indicator to Any Broker“.

All details mentioned in AlgoDelta are for informational and demo purposes only. AlgoDelta does not provide profit-making statements.